Making the Money Flows Make Sense

How Regal.ia Is Reimagining Return, Risk, and Participation

Much of the conversation about Africa’s investment gap focuses on perception: risk narratives, mispriced capital, and outdated assumptions about performance. Those critiques are valid. But they only tell half the story.

The deeper challenge — and the deeper opportunity — lies in how money actually moves, who it moves for, and who is structurally excluded from the returns it generates.

Regal.ia was built to engage that full picture. Not just to correct misperceptions of risk —but to restructure how value is created, distributed, and reinvested across communities, projects, and people.

The Problem Isn’t Just Cost of Capital — It’s Concentration of Return

Traditional development and investment models tend to optimize for a narrow outcome: How does this project maximize returns for the developer or primary investor?

That framing creates several distortions:

- Capital stacks become unnecessarily rigid

- Risk is pushed downward, while upside is concentrated upward

- Communities participate as beneficiaries or labor — rarely as stakeholders

- Returns leak out of local economies instead of compounding within them

Even when projects “work,” the value they generate often bypasses the very people and places that make them viable.

This isn’t a moral failure — it’s a design failure.

And design failures can be corrected.

Regal.ia Starts Where Money Already Is

One of the core principles behind Regal.ia is simple: You don’t fix capital systems by ignoring how they currently function.

Money already moves — through banks, DFIs, developers, donors, municipalities, households, informal networks, remittances, grants, and debt.

The problem is that these flows are:

- poorly coordinated

- rarely interoperable

- optimized in isolation

- blind to their combined impact

Regal.ia is designed to map, model, and connect existing flows, not replace them. The goal is not disruption for its own sake —but coherence.

From Risk Reduction to Return Expansion

Most “de-risking” conversations focus on protecting capital.

Regal.ia extends that logic by asking a parallel question:

What happens when we expand who gets to participate in the return?

When communities, users, workers, and local institutions have pathways to ownership, revenue participation, or long-term upside, several things change at once:

- Incentives align across the system

- Utilization improves

- Informal risk-sharing becomes visible

- Projects stabilize faster

- Capital becomes more patient — because outcomes are shared

This is not theoretical. It’s how resilient systems behave.

Stacking Capital With Intention

Across Critical Conversations, a consistent theme has emerged:

Capital works best when different types of money are allowed to do what they’re good at — together.

Regal.ia is being developed with this reality in mind.

Instead of forcing all capital into a single logic, the platform supports intentional capital stacking, where:

- Grants absorb early uncertainty

- Concessional capital extends runway

- Commercial debt funds predictable cash flows

- Equity participates where upside truly exists

- Community capital anchors long-term commitment

The value is not just in the stack —

it’s in

understanding how the layers interact over time.

Regal.ia’s tooling is oriented toward making these interactions legible, testable, and adaptable.

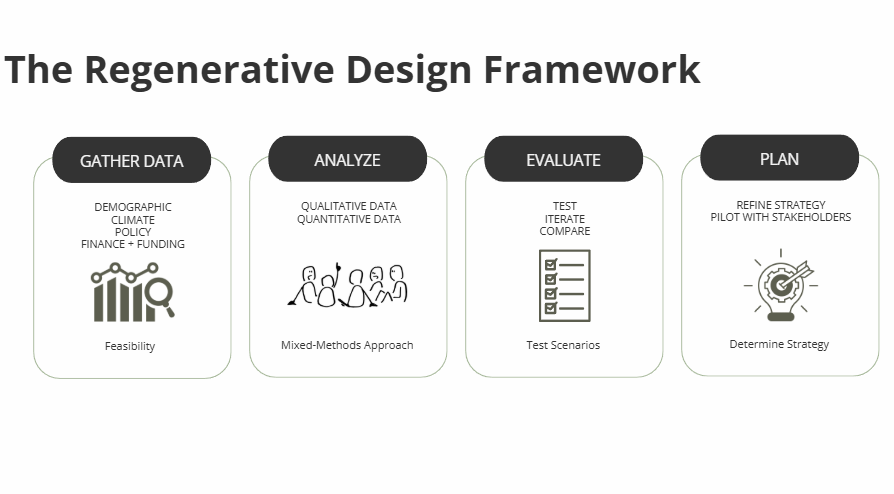

Scenario Thinking as a Financial Tool

One of the most underused tools in development finance is scenario design.

Rather than asking:What’s the one model that works?

Regal.ia asks:

What changes when ownership, access, timing, or participation shifts?

Scenario modeling allows stakeholders to explore:

- alternative ownership structures

- fractional or collective participation

- revenue-sharing mechanisms

- community-aligned incentives

- long-term vs short-term return tradeoffs

This is not about abstraction. It’s about making consequences visible before capital is committed.

Why This Matters for ROI

Expanding participation in return does not dilute value — it often increases it.

Projects that:

- retain value locally

- reward users and operators

- align incentives across stakeholders

- reinvest in surrounding systems

tend to outperform over time. Not because they are “nicer,” but because they are structurally more efficient. They adapt faster, earn trust earlier. In turn, reduces friction, which is expensive.

Regal.ia as Infrastructure, Not Intervention

Regal.ia is not a fund. It is not a lender. It is not a replacement for existing institutions. It is infrastructure — designed to help capital behave more intelligently across complexity.

By:

- clarifying how money moves

- revealing where value accumulates or escapes

- enabling better capital stacking

- expanding access to participation and return

- grounding decisions in lived economic reality

Regal.ia supports a shift from extractive efficiency to systemic performance.

Making the Flows Make Sense

Africa’s investment challenge is not that money is absent. It’s that flows are misaligned, incomplete, and too narrowly optimized.

The work ahead — through Regal.ia and Critical Conversations — is about redesigning those flows so they:

- reflect reality

- reward contribution

- respect complexity

- and generate value for more than one balance sheet

Not by forcing a new system into place —but by

making what already exists work better for everyone. That is the opportunity. And that is the work.